I’m searching for the best FTSE 100 dividend stocks to add to my portfolio next month. And I’m thinking of boosting my holdings in the following UK blue-chip shares.

Here’s why I think they have a place in any winning shares portfolio.

Ashtead Group

Rental equipment specialist Ashtead Group (LSE:AHT) is one of the FTSE’s greatest dividend aristocrats. The dividend yield for this financial year (to April 2024) isn’t the greatest. It stands at 1.5%, some way below the 3.7% index average.

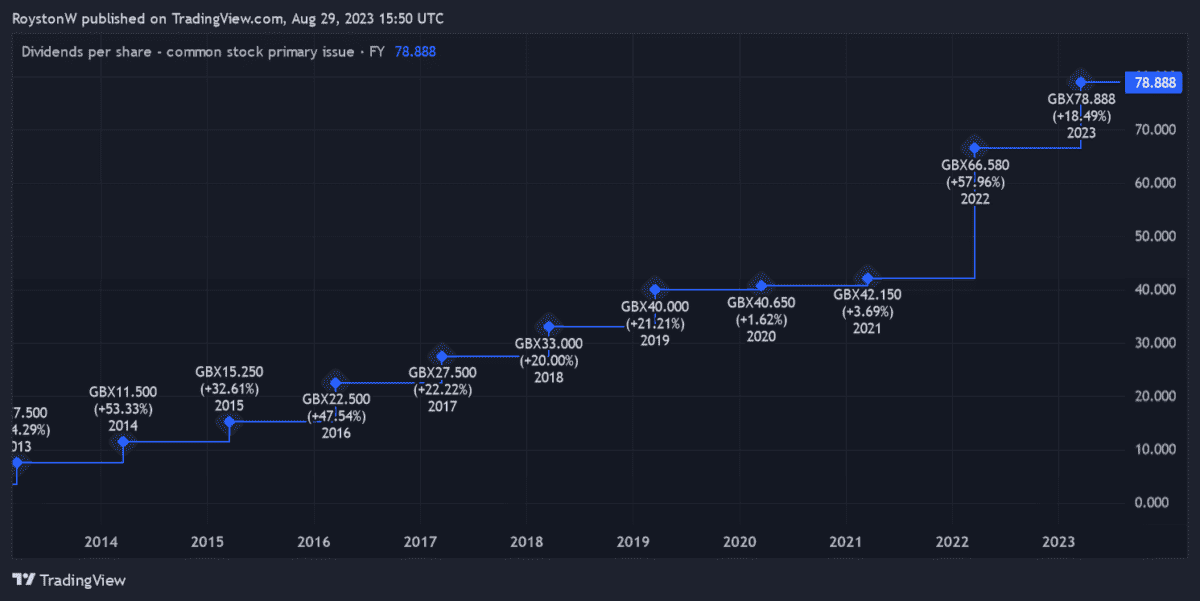

Despite this, I’m still open to buying more shares. The company’s excellent record of dividend growth (as shown in the chart below) meant it provided the best returns of any UK share during the 2010s, and continues to outperform much of the FTSE 100.

As a long-term investor, I’m looking for shares that can deliver a sustainable and growing dividend over time. This gives me a great chance to grow my wealth, even during periods of high inflation.

And I’m confident Ashtead can keep its proud record of dividend growth going. Cash generation remains highly impressive, giving it the means to increase shareholder payouts as well as buy back shares. The firm launched a fresh $500m share buyback scheme just a few months back.

A strong balance sheet also gives it the financial firepower to keep making earnings-boosting acquisitions, providing added ammunition for future dividend growth. The FTSE firm has steadily grown its market share over the past decade through acquisition activity. And it has plenty of scope to continue expanding, given the highly fragmented nature of its industry.

It’s true that acquisitions can erode shareholder value if they go wrong. But Ashtead’s strong track record on this front helps soothe any fears I might have.

DS Smith

Packaging manufacturer DS Smith (LSE:SMDS) is another dividend stock on my radar. It had a solid history of raising dividends until the Covid-19 crisis came along and shareholder payouts were ditched.

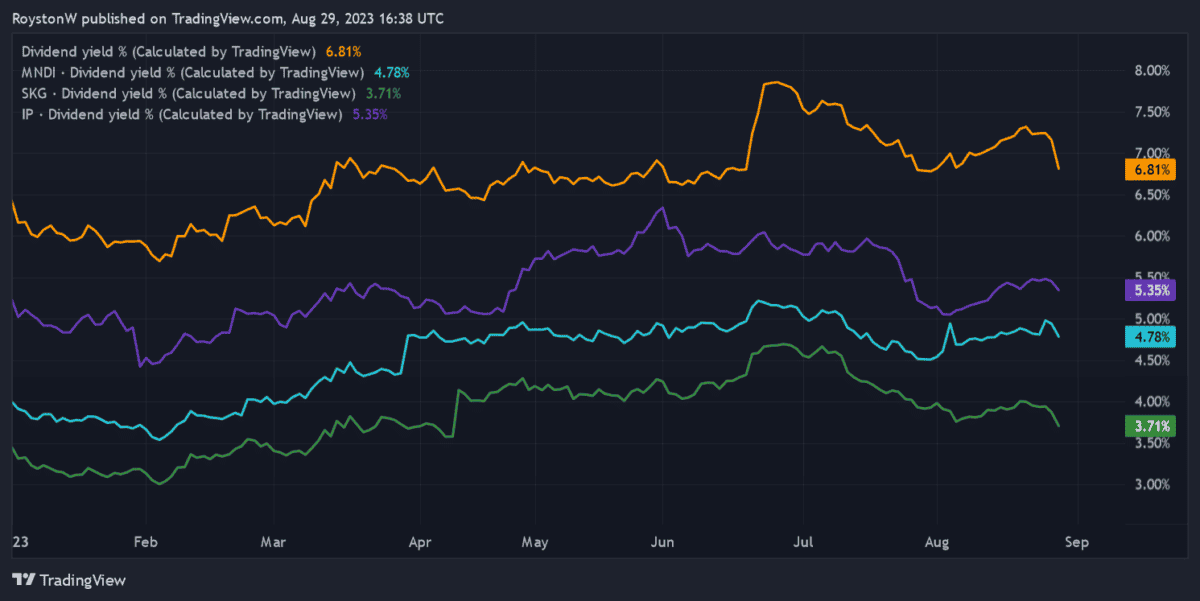

Dividends are growing strongly once again and, as a result, the business carries a market-beating yield for this year (as the chart below shows).

Not only does its 6%+ dividend yield for this year (to April 2024) also sail past the FTSE 100’s average, it beats industry rivals International Paper, Smurfit Kappa and Mondi as well.

DS Smith makes the boxes that let e-commerce companies like Amazon reach their customers. It also supplies packaging and in-store displays that fast-moving consumer goods (FMCG) companies and supermarkets love.

Encouragingly, these sectors are tipped for solid growth over the coming decades. And because DS Smith is in rude financial health, it has the means to continue expanding its global reach and product ranges through more acquisitions. The firm’s net-debt-to-EBITDA ratio fell further last year to just 1.3 times.

Profits could suffer in the near term if economic conditions remain tough. But as someone who buys shares for the long term I still believe it’s a top buy at current prices.